{{item.title}}

The European Union is increasing transparency to identify potentially aggressive tax planning models.

The amended provisions of EU Directive 2011/16/EU, which concerns mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements (referred to as “DAC 6”), have significant implications for taxpayers and tax advisors alike.

DAC 6 sets out reporting requirements for certain tax arrangements with cross-border features, provided that one or more of the hallmarks of such arrangements are fulfilled. Certain hallmarks which lead to a reporting requirement depend on one of the main benefits of the model being a tax advantage. The EU has developed a joint communication network (Common Communication Network, CCN) via which the mandatory automatic exchange of information in relation to reportable cross-border arrangements takes place. In Austria, this was implemented via the Austrian EU Reporting Requirement Act (EU-MPfG).

The Directive entered into force on 1 July 2020, but due to a retrospective reporting obligation also covered tax arrangements which were implemented after 25 June 2018. This is why you need to take action now!

DAC 6 sets out reporting requirements for certain tax arrangements with cross-border features, provided that one or more of the hallmarks of such arrangements set out in the Directive are fulfilled. Some of these hallmarks further envisage that one of the main benefits of an arrangement is a tax saving. The EU has developed a joint communication network (Common Communication Network, CCN) via which the mandatory automatic exchange of information in relation to reportable cross-border arrangements takes place.

An arrangement can be termed “cross-border” if it affects more than one EU Member State, or an EU Member State and a third country, and one of the following criteria is fulfilled:

Not all participants in the arrangement are tax resident in the same country.

One or more participants are tax resident in more than one country or do not have any tax residency.

One or more participants carries on its business through a permanent establishment situated in another country and the arrangement encompasses either a part or the whole of the business of that permanent establishment.

One or more participants carries on an activity in another country without being resident for tax purposes or creating a permanent establishment in that country.

The arrangement potentially has an impact on the automatic exchange of information or the identification of the beneficial owners.

Cross-border tax planning models need to be reported if they have at least one of the following hallmarks (selection from Austrian implementing legislation):

§5 EU-MPfG Unconditionally reportable arrangements – no main benefit test required

Cross-border payments within the group (e.g. if the recipient does not have tax residency or has tax residency in a jurisdiction on the EU/OECD “non-cooperative” list).

Deductions for the same depreciation on an asset are claimed in more than one jurisdiction.

Relief from double taxation for the same income or capital is claimed in more than one country.

Model to circumvent automatic exchange of information for financial accounts in OECD or EU states, or a model which serves to hide the ultimate beneficial owner (UBO)

Transfer pricing arrangements (e.g. for hard-to-value intangibles or when using unilateral “safe-harbour rules”).

§ 6 Conditionally reportable arrangements – the reporting obligation depends on the main benefit test (Is one of the main benefits of the arrangement a tax benefit?).

The taxpayer is subject to a confidentiality clause.

The intermediary’s fee is linked (in whole or in part) to the tax benefit.

A “standardised” tax arrangement (tax model) exists for more than one taxpayer.

A model aimed at intentionally generating a loss

Converting income into capital, gifts or other low-taxed revenue

Circular transactions (“round tripping”)

Deductible cross-border payments within a group when the tax burden of the recipient is 0% or almost 0%, or for which a comprehensive tax exemption or a tax reduction applies.

On 7 July 2020, the Austrian Ministry of Finance published a draft version of the information notice regarding the application of the Austrian EU Reporting Requirement Act (EU-MPfG). This indicates that the option envisaged on the EU level to postpone the entry into force of the DAC 6 Directive will not be used and the reporting deadlines laid out in the EU-MPfG will in principle remain unaffected. As the notice states, technical delays will cause a “de facto” postponement of the reporting requirement. The following deadlines must be observed:

25 June 2018: Directive enters into force and transitional phase begins, i.e., intermediaries and taxpayers have to monitor the relevant cross-border tax arrangements in relation to which the first step in implementation was made between 25 June 2018 and 1 July 2020.

The Directive was transposed into Austrian law on 22 October 2019 via the Austrian EU Reporting Requirement Act (EU-MPfG).

24 June 2020: Amending Directive envisages an option to postpone the start of the reporting requirement by six months. Austria does not make use of this option.

July 2020: The EU-MPfG enters into force in Austria.

From October 2020: Possible to submit notifications regarding reportable arrangements via FinanzOnline

End of October 2020: Deadline for reporting tax arrangements implemented from 1 July 2021 (from the end of October 2020, the reporting deadline of 30 days set out in the EU-MPfG applies).

End of October 2020: Deadline for reporting tax arrangements which were implemented between 15 June 2018 and 01 July 2020 (retrospectively)

End of October 2020: first quarterly exchange between Member States

The following information is covered by the reporting requirement:

intermediaries or relevant taxpayers

the hallmarks which triggered the reporting requirement

summary of the details of the reportable arrangement

date on which the first step towards implementation is intended to be made or was made

details regarding the respective national tax regulations on which the reportable arrangement is based

value of the reportable arrangement

Member States affected by the reportable arrangement

These new EU regulations affect anyone who develops, markets, organises, implements or provides tax arrangements with a cross-border element within the EU, as well as anyone who provides support and consulting in this regard. Both companies and individuals may be affected by the new rules. You can use the following table to check whether the rules are of relevance to you (basic scenarios):

| Who is affected? | Why? | What are the effects? |

| Companies domiciled in the EU and/or which have permanent establishments in the EU | Certain EU cross-border tax arrangements (developed in-house or together with consultants) are reportable. | Reporting of certain tax arrangements to the local tax authorities – either by the advisor or the taxpayer |

| Tax advisors, lawyers, or consultants who coordinate certain tax arrangements | Intermediaries include individuals who coordinate tax arrangements or offer support/consulting services in relation to them. | EU taxpayers have to report certain tax arrangements to their local tax authorities. |

| Private individuals resident in the EU | The structuring of deals or transactions on a cross-border basis may be reportable. | Reporting of certain tax arrangements to the local tax authorities – either by the advisor or the taxpayer |

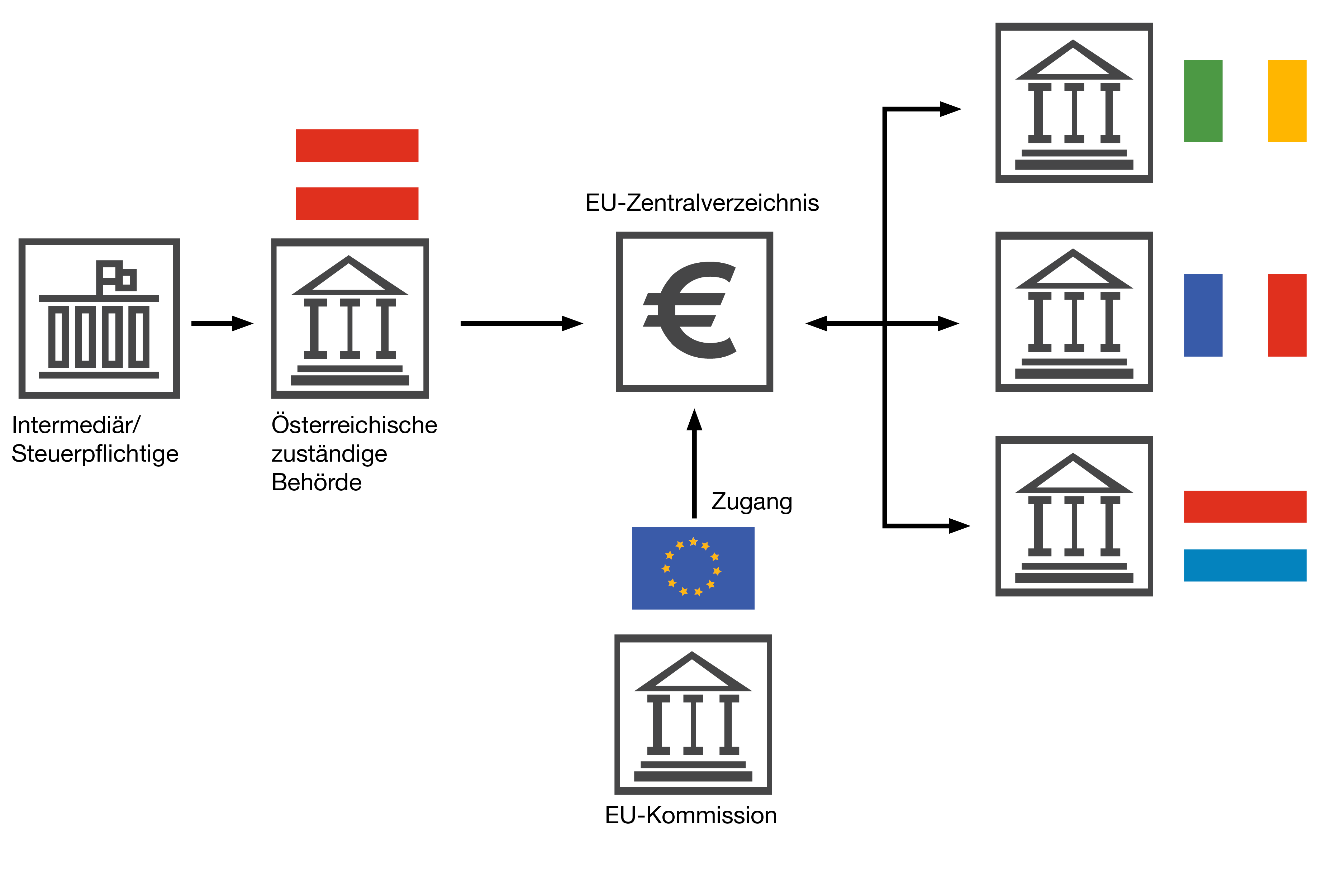

1 – Intermediaries who design, market, organise, implement, or facilitate reportable EU cross-border transactions or a series of transactions, as well as individuals who offer support or advice in this context.

2a – In accordance with the new EU guidelines, intermediaries must report “potentially aggressive tax arrangements” to the competent national tax authority.

2b – If the intermediary has not reported the model due to a professional privilege, the taxpayer is required to do so.

3 – The national tax authority will automatically share this information on a quarterly basis with the tax authority of the EU Member State in which the taxpayer is resident via the common communication network (CCN).

The reportable tax arrangements must be reported within 30 days to the competent national authority. The reporting period begins either:

on the day on which the arrangement is made available for implementation

or as soon as the arrangement can be implemented

or when the first step towards implementation is taken.

The decisive factor is which of the above events occurs first.

It is important to correctly assess the regulations and their effects. We look closely at the practical impact of the Directive and work closely with our clients as well as colleagues from the international PwC network. Do you have any questions or require support?