M&A Integration & Separation

The complexity of a transaction across all business areas frequently leads to loss in value instead of the anticipated efficiency gains and value growth. For transactions to have an optimal impact on results, we provide support on operational implementation before, during and after the acquisition or sale of a business. Our services include the following:

Value Creation

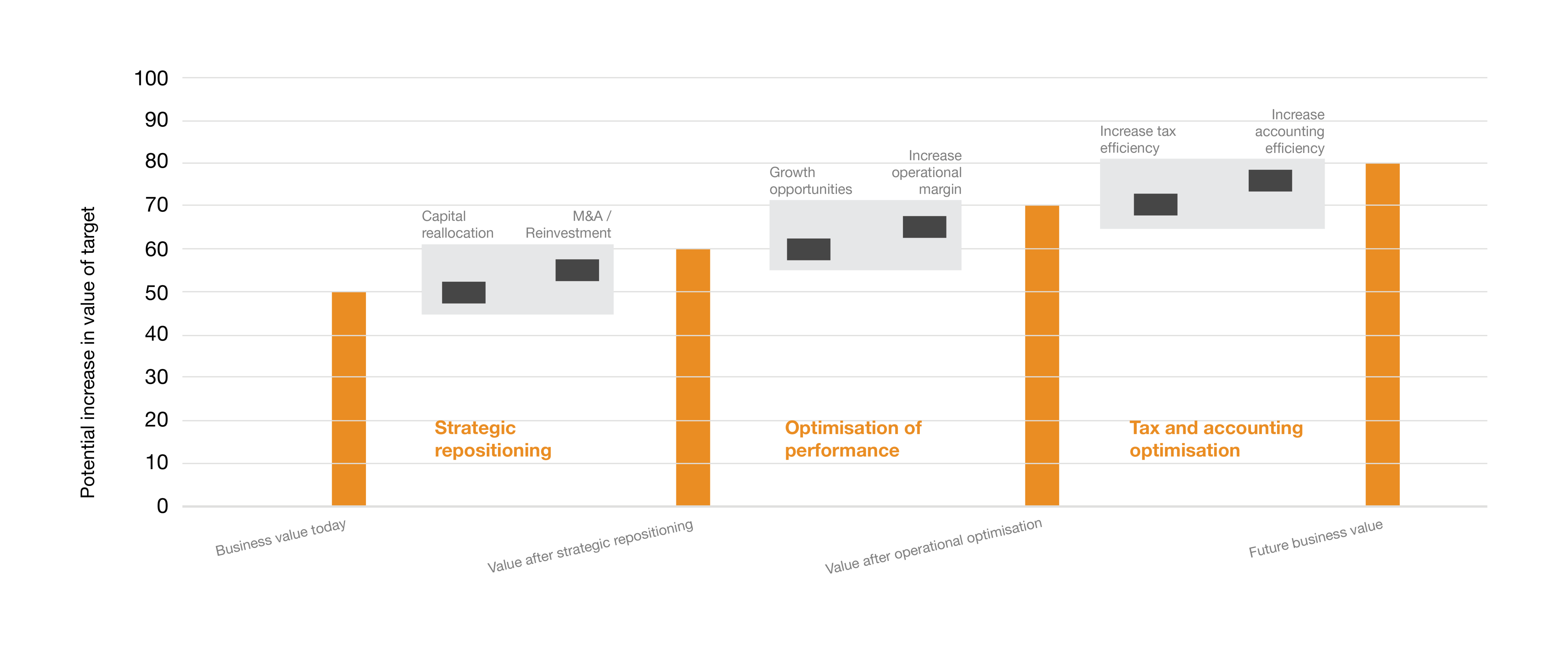

To maximise value creation in a transaction, it is essential to get an all-round view of the most important value drivers. Our PwC experts can support you during the full transaction cycle on all topics, in order to identify and implement the most important opportunities for value creation.

Synergy Management

Effective management of synergies begins long before due diligence. Our experts identify and evaluate possible synergies in a realistic way, so that they can be realised after the acquisition. In practice, synergy effects are frequently over-estimated, which leads to acquisition prices that are too high. PwC experts support implementation of synergy projects in order to measure the financial impacts.

Carve-out

Irrespective of the type, scope and complexity of a carve-out, our experienced PwC experts can support you with everything from planning and implementation through to optimisation of the target company.

To carry out a transaction which maximises the value of business units, we offer support in the following areas:

- Support for the seller for carve-outs of business units in the planning phase (separation plans) and during implementation.

- Support during the sale and preparation for day one, in order to ensure a smooth transaction and closing.

- Support for the seller during the due diligence phase (carve-out due diligence)

- Preparation of carve-out balance sheet and profit and loss account

M&A Integration

A successful transaction largely depends on its implementation. But more than half of all business transactions fail due to lack of experience in post-merger integration (PMI).

To successfully implement an integration, our PwC experts provide support in the following areas:

- Identification and quantification of potential synergies and risks

- Development of an integration strategy and a takeover plan including the target operating model (TOM)

- Preparation of detailed planning for day one, as well as the first 100 days after takeover, and implementation of these via structured project management (IMO)

- Implementation and monitoring of KPIs

- Optimisation of organisational culture and processes

Operational due diligence

Operational due diligence (ODD) helps the buyer to better understand the main operational processes, costs, risks and opportunities within a company. Our PwC experts can rapidly provide a detailed overview of the most important value creation drivers and risks, in order to give buyers an advantage in the bidding process.

Operational improvement

PwC supports companies to identify and analyse the most important drivers of value creation in their operational activities. Analysis of value drivers aims to identify areas of the company where there is room for improvement. The resulting plans could include improvements to the product portfolio, the implementation of strategic procurement, cost optimisation or the development of new locations.